-

Posts

425 -

Joined

-

Last visited

-

Days Won

5

Clay Diggins last won the day on May 6 2023

Clay Diggins had the most liked content!

Profile Information

-

Gender

Male

-

Location:

The Great Southwest

Contact Methods

-

Website URL

http://www.minerdiggins.com

Clay Diggins's Achievements

Silver Contributor (4/6)

1.1k

Reputation

-

These figures were created by the BLM itself. Usually Land Matters does analysis from their copy of the BLM MLRS database but in this case the BLM created this mapping directly from the original database. Claims that show $0 in fees are either claims that were closed before 1994 or small miners claims that are exempt from the maintenance fee. It could be that the claim status was changed to closed procedurally on November 17th. More likely is that the claim legal land description (LLD) is incorrectly described by the BLM. This is surprisingly common and results in the claim being unmappable. There are about 20 new mining claims located each month that have improper LLDs. All together there are about 36,350 closed and active mining claims in the MRLS database that have unusable LLDs and can't be mapped. In planning for the new MLRS database we pushed for some better control over these case file inputs to solve these errors and that became a part of the MLRS rollout plan. Unfortunately all those years of planning were thrown out when the MLRS was rolled out early, unannounced and incomplete on January 21, 2021. Since then claim file information input has been much worse. Often the information is incomplete to the point of being unusable. That wasn't nearly as big a problem with the old LR2000. Land Matters can't fix this problem and obviously the BLM has no desire to deal with this but the claim owners can. I continue to strongly advise claim owners to check and correct errors like these in their BLM case files. With many changes in the database structure happening often and without notice these errors can pop up at any time. If your claim isn't on the map or a search doesn't show your claim where you expect it to be something is wrong with the case file. There are much bigger problems looming with the MLRS. The BLM is aware of the MLRS problems but they have had no success convincing their contractors to track down the issues much less solve them. The BLM no longer has direct access to the code that runs the MLRS - that's been contracted out to Salesforce in San Francisco. I expect the MLRS will eventually fail unless the BLM contractors start taking these problems more seriously and put some real effort into fixing their code.

-

Clay Diggins started following Gold From Meteorites?

-

ALL the elements on earth come from meteorites. Earth is a ball of accreted matter from space. After the material accreted it was processed by the standard geological processes - pressure, heat and erosion in the form of vulcanism, plate movement, convection and sedimentation. It was those geological processes that concentrated gold into veins that eventually eroded into placer deposits. Those same processes created our atmosphere which acts to slow and deflect the arrival of new meteorites. All those same processes continue today. The article made those same points except the one about our atmosphere. The theory proposed in the article is based on the spike of one element's occurrence in earth's timeline. The theory seems plausible but it's just one theory attempting to explain earths metallic abundance. The gold you find in placer deposits all came from meteorites but no measurable amount of that gold in a placer deposit or a vein was deposited directly by meteorites.

-

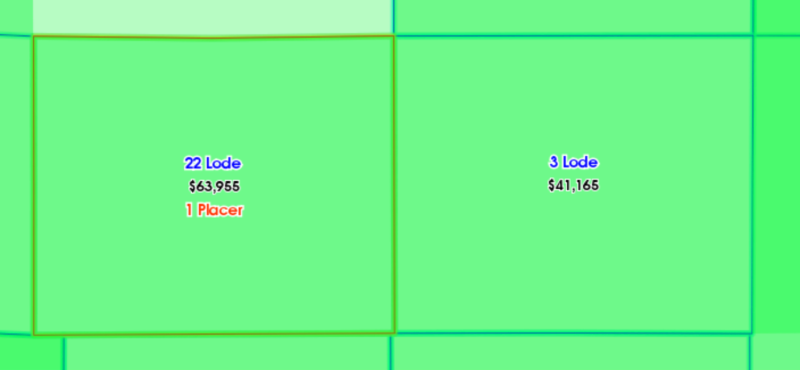

We've added a new mapping layer to the Land Matters Mining Claim Maps. You will find the new layer under the "Claims" mapping group on every mining claim map. It's named "Mining Claim Fees Paid". The mining claim maps start without the new layer displaying so you will need click the checkbox next to the layer name to begin using this map layer. This new map layer shows the total amount of maintenance fees paid to the BLM for each Section since annual Maintenance fees were begun in 1993. These fee totals are for annual maintenance only and do not include filing or locating fees or the costs associated with State recording fees. Mining bonds and permit expenses are not included. Each Section that has had claims during the period from 1979-2024 are represented in green on the map. The more fees that have been paid for the section the darker the green. Some sections may have $0 in fees paid yet show several claims. These are Sections where all claims were closed before the maintenance fees began in 1993. As you zoom in the amount of fees paid will be displayed in the section. In this example the Fees Paid are displayed between the normal active mining claims display. To get Information at any zoom level you can select the information tool and click on your area of interest will return a window with the number of claims and the total of fees paid in that section. As with all our mining claim maps the current or prior existence of mining claims does not mean that the area is now open to new mining claims. What are annual maintenance fees? Until 1993 all Mining Claims were held by completing a minimum of $100 worth of development work per claim per year. This was known as the mining claim labor requirement. If you didn't perform work on your mining claim each year before 1993 they became invalid. In 1993 Congress, at the request of the BLM, enabled claim owners to pay an annual fee of $100 instead of completing their annual claim development work. This brought in funds to the BLM to administer the program as well as relieving them of their responsibility to check existing mining claims for evidence of development work. No longer did the BLM need to do field work to administer mining claims. Since 1993 the annual claim fees have risen to $165 per year for each Lode claim and $165 per 20 acres for each placer claim. Placer claim fees can be as much as $1,320 per claim. Unlike other government programs the mining claim case administration system at the BLM is entirely supported by claim owner fees. These annual mining claim maintenance fees are paid directly to each BLM State office to offset the costs associated with administrating the mining claim case files. No public monies are used. Here are the totals by State of mining claim fees paid for the years 1994 - 2023 Arizona $507,229,955 California $385,681,600 Colorado $380,865,975 Idaho $307,600,865 Montana. $224,791,660 Nevada $1,523,212,855 New Mexico $190,491,505 Oregon $99,909,290 South Dakota $107,769,290 Utah $556,540,015 Washington. $53,075,435 Wyoming $468,886,230 Total $4,806,054,675 Nearly 5 Billion dollars have been spent by mining claim owners to support BLM mining claim administration. The BLM is now collecting more than 83 million dollars in mining claim maintenance fees each year.

-

Nevada Prospecting On Private Land With Permission

Clay Diggins replied to Lead Detector's topic in Detector Prospector Forum

Good logical question Redz. If a lode deposit is discovered on a placer claim AND the claim owner wishes to go to patent the lode deposit will be excluded from the placer patent unless it has been claimed and paid for. Also if a placer claim owner gives permission to a non owner to prospect the placer claim and the non owner discovers a lode deposit the non owner can claim a new lode claim. The new lode claim displaces the pre-existing placer claim within the new lode boundaries. That might seem like a far fetched possibility until you consider all the prospecting clubs that permit their members to freely prospect their placer claims. I encourage all prospecting clubs to put a clause in their member contracts to avoid this situation. Interestingly the only reason for all this complexity of placer versus lode is because a lode patent costs twice as much per acre as a placer patent. Lode= $5.00 per acre, Placer = $2.50 per acre. The government would lose $2.50 an acre if known lodes were patented within a placer patent. That was a lot of money in 1872 when Congress set the fees. Congress hasn't changed the acre patent fees since 1872. Here is a link to the placer claim patent law. https://www.law.cornell.edu/uscode/text/30/37 -

Nevada Prospecting On Private Land With Permission

Clay Diggins replied to Lead Detector's topic in Detector Prospector Forum

Different states do treat lost, stolen or abandoned property differently. In this particular situation the owners bought the property without any reservations (lock, stock and barrel). In other words they own anything found on the property even though it was originally lost or abandoned. Stolen property is a different story for obvious reasons. That makes it pretty simple. Anything on the property that wasn't stolen belongs to the owners. If they give you permission to search for and keep the stuff you find then it becomes your property. So you could keep the nugget and the coins unless they were known to be stolen. I know of no exceptions in any law to that principle. _______________________ Surface rights are the rights to beneficial use of the surface (agriculture, roads, buildings etc.) and for physical support for real estate. Surface rights don't include any minerals. Valid placer and lode claimants have exclusive ownership of ALL the locatable minerals found within their claim boundaries. The rights of placer and lode claimants to any and all minerals found on their claims are equal. A placer can not be located over a lode claim. A lode claim can only be located over a placer with the knowledge and permission of the placer owner and even then only if a lode deposit has been discovered within the boundaries of the placer claim. In that situation the new lode claim replaces the placer claim within the lode claim's boundaries. -

Nevada Prospecting On Private Land With Permission

Clay Diggins replied to Lead Detector's topic in Detector Prospector Forum

Please don't PM me any pictures you took of yourself in the mirror! I get too many of those already from miners. ((((shudder)))) -

Nevada Prospecting On Private Land With Permission

Clay Diggins replied to Lead Detector's topic in Detector Prospector Forum

Lead shared the location with me privately. I checked the land status. There was no way you could know that. No need to feel chastised for what you don't know. I certainly didn't intend to chastise anyone. But that's really the point. If you don't know it's better to find out before you go. Lead did the right thing and I'm pretty sure he has more confidence now. Confident, informed prospectors are 32.8% more successful and at least 13.2% more attractive. -

I'm not all that familiar with the tenement system. Do these tenements have rights to all minerals or just gold? In the United State most mining claims are not located for gold. Closed mining claims are more about looking back on other people's dreams and hopes for a non gold mineral deposit. Assuming these closed claims represent potential gold mineralization without other confirmation can lead to wild goose chases. Is it the same with tenements?

-

Nevada Prospecting On Private Land With Permission

Clay Diggins replied to Lead Detector's topic in Detector Prospector Forum

Low risk? Usually. The land in question is in a very productive historical and current mining district and has been under mineral lease to a large mining company in the past. It's a purchased property - It's never been claimed and the original patent was not mineral related. It really is more complex than the owner told me it was OK. Maybe if you were detecting barren sand pits it wouldn't be a problem but entering private property in a mineralized district still requires due diligence. At the very least you need to check if the owner actually owns the minerals. More than 90% of landowners in the U.S. do not have mineral rights on their property. If you asked them most would say "of course I own the minerals". -

Nevada Prospecting On Private Land With Permission

Clay Diggins replied to Lead Detector's topic in Detector Prospector Forum

MLRS lode claim lines on private property could indicate: The private property does not have mineral rights and the minerals are open to location. (least likely) Individuals have located mining claims on private land not open to location. (most likely) The MLRS PLSS mapping is messed up and the claims are displaying in the wrong place. (likely depending on location - Oregon and California in particular are a mess) The MLRS can not be used to determine mineral rights. The BLM does not determine individual or private mineral rights. To determine if the land is open to location you will need to study the Master Title Plat for the Township. If you need help with a particular location PM me with the Township/Range/Section(s). -

Nevada Prospecting On Private Land With Permission

Clay Diggins replied to Lead Detector's topic in Detector Prospector Forum

Mining claims can only be located on public lands open to location. Private land is neither public nor open to location so the simplest answer is "no". If the property owner owns both the surface and the minerals there is no need for a mining claim and locating one would be a waste of money and time as the claim would be invalid. If the private land was acquired through a land patent that did not include the minerals then the owner can not give you permission to prospect. There are many types of land patents that did not transfer the minerals into private ownership. The most common in Nevada are the Stock Raising and Homestead (SRH) patents. If the land was acquired through an SRH patent there is a process whereby you can prospect and locate mining claims on those private lands with 30 day notice and bond. Clear as mud? -

I think you may misunderstand the situation Dan. I like what Phil and Steve have been doing. They are probably the most engaged and sharing of the hobby miners in California. Their outings have been fun and instructional for many visitors. The Coolgardie area is not mining restricted. It is in fact part of one of the largest and most productive mining complexes on earth. There is still a lot of active commercial mining interest there. The Section the Placer Pete mining claim is located in is not limited to hobby mining. As I stated before it may be possible to arrange a mining lease with the BLM. The restriction on that section is not a prohibition on mining but it is closed to mining claims. There can be no valid mining claims located in that section because it is "not open to entry" (NOE). That is clearly marked on the Master Title Plat as well as the case file for the Placer Pete claim. I hope Phil and Steve can keep doing what they have been doing. I doubt the California BLM will change their internal policy to never check on mining claim validity. As long as BLM does not do what claim owners pay them to do the Placer Pete "mining claim" is probably going to keep paying annual fees for a void mining claim. I don't have a beef with Steve or Phil. Having a beef with California BLM would be futile and one sided. The California BLM has not administered mining claims for many years. My interest in this is to educate small miners why many (most?) of their mining claims are eventually declared void by the BLM. Locating mining claims on land not open to location is the small miners most common mistake. Not checking the federal government's official record of mineral title on the Master Title Plat is the main reason these void claims are located. The Placer Pete claim is a perfect example of this problem. Learn to use the Master Title Plats and the problem disappears. It's a simple matter of education. Land Matters has videos and books for download in their Tutorials section that delve into using Master Title Plats. It's not simple stuff, you will have to study for a few hours. Master Title Plats are the first, and often the most important, step in locating a mining claim. Millions of dollars are wasted each year by miners paying for and developing deposits on "claims" that are void when they are located. Educate yourself and prosper. Barry

-

What Type Of Workings Is This?

Clay Diggins replied to Lead Detector's topic in Detector Prospector Forum

It could be a borrow pit. I'm not seeing any real mining activity but I haven't been there. Try turning on the "MRDS Mines" and "Topo Mineral Feature" map layers on your Land Matters map. If it's a traditional borrow pit it will be listed. If it's on BLM managed land check the MLRS case reports for mineral leases or sales. It could be an active site even if there are no mining claims. https://reports.blm.gov/report/MLRS/112/CR-Geographic-Report-with-Customer/ -

What Type Of Workings Is This?

Clay Diggins replied to Lead Detector's topic in Detector Prospector Forum

I was thinking the "drill" hole was actually a fumarole. It looks bigger than 2" in the video. Fumeroles are very common in volcanic ash deposits. I'm not positive about the volcanic ash but in the video the broken surfaces exhibit the characteristics I've come to associate with ash flows. Most active mining in Elko is for gold and/or silver although there are large Barite and Limestone mining operations as well. -

What Type Of Workings Is This?

Clay Diggins replied to Lead Detector's topic in Detector Prospector Forum

It looks like a volcanic ash deposit. If so it could be they were prospecting for quality pozzolan. There is a lot of pozzolan mining in Nevada. Is this in Churchill county? There has been a lot of sampling and claiming of pozzolan deposits there recently. Quality pozzolan can be claimed like any other valuable mineral. Regular volcanic ash deposits can't support a mining claim. Quantifying and proving a pozzolan deposit is usually done by scraping the surface in the exploration stage. https://www.concrete.org/tools/frequentlyaskedquestions.aspx?faqid=689