Search the Community

Showing results for tags 'gold news'.

-

This is a list of top 10 countries that hold gold. Top 10 Gold Holding Countries How many Olympic swimming pools is this? haha

-

The annual Australian Kangaroo includes a popular 1oz coin which in 2024 features an exceptional design that investors will eye as a new classic. Key features: 99.99% pure gold...2024 kangaroo design...Special ‘P125’ anniversary mintmark...Australian legal tender...Authentication feature.

-

Pictures of nuggets from Russia are rare. Not all of these are gold but some very nice ones are! 10 STUNNING precious nuggets found in Russia (bignewsnetwork.com)

-

This is an interesting article about reducing mercury emissions in artisanal gold mining.. I learned that artisanal and small-scale gold mining supplies about 20% of the gold bought and sold around the world. At the same time, these mines account for 40% of the global emissions of mercury—a neurotoxic metal—into the atmosphere. That's more than any other source, including the burning of fossil fuels, which are naturally laced with trace amounts of mercury. What becomes of that atmospheric mercury largely remains a mystery. The article then describes how a team of scientists worked with miners and their communities to reduce mercury emissions, including through recycling.. It's a science report with the usual stuff about control groups so it might not be to everyone's taste.. for others it could be a good lazy weekend read.. https://phys.org/news/2023-12-detoxifying-gold.html

-

And maybe you will get a higher price. How traceability of gold became a focus for independent jewellers (ft.com)

-

Here's a bit of current info about gold hunting around Fresno. Storms — human and atmospheric — fuel ‘second gold rush’ - The Business Journal

-

This article makes me wish I lived closer to the gold field up in that area! There's Gold in Them There Hills...or, at Least Across Washington (newstalk870.am)

-

- 2

-

-

- advice and tips

- gold news

-

(and 1 more)

Tagged with:

-

There is no evidence that it was from a gold source so then where could it have come from? 17th Century English Pirates Hid In The American Colonies (nationworldnews.com)

-

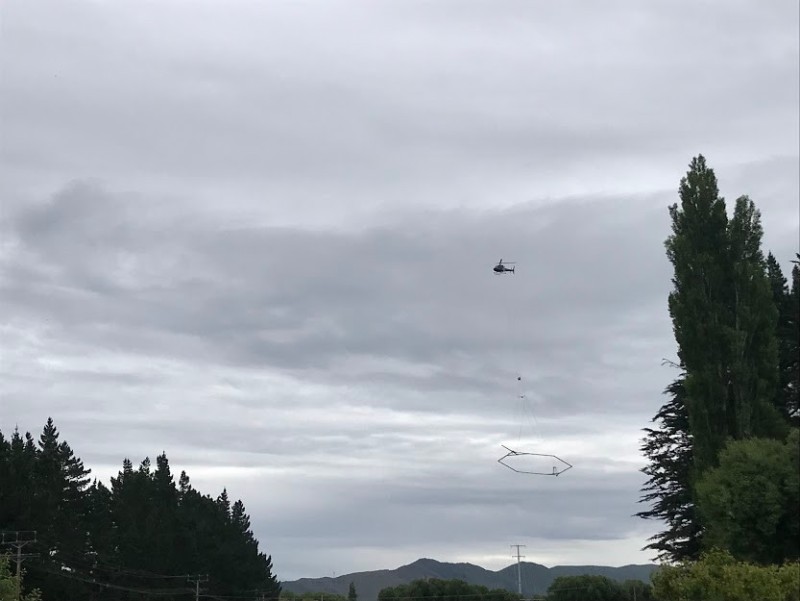

A while ago I put up this story from the Australian news about a giant coil towed around under a helicopter looking for gold in outback Australia, it's a very cool thing some may have missed it The past week or so a helicopter has been buzzing around my area, I'm not sure what it's up to but it also has a giant coil type thing hanging underneath it, It seems to be flying around in the valleys around my general area. A gold mine very close to where I live that they pulled 80,000 ounces of gold out of recently closed, so perhaps they're looking for a new spot? I have no idea. Here is a story about the gold mine near me closing https://www.stuff.co.nz/southland-times/news/111691272/waikaia-gold-finishes-mining-operations-at-freshford-in-northern-southland Every time the helicopter zipped past I was either driving along or just not ready for a photo but this morning it was going up and down directly behind my house. My house is right next to a river and they appeared to be flying up and down the river. I took these photos from a window at the back of my house as it flew past. The coil in this photo would be right on the river. Not sure if they're looking for gold, but it'd be pretty cool if they are.

-

The G7 summit yesterday announced a ban on Russian gold exports. Russia produces nearly 10% of global supply. Expectations are that the price will rise notably over the next month or so. Hang onto your yella if ya got any!

-

I know that this may not be the correct location but there are a few members here that frequented GPEX. I am just wondering if anybody has any information as to why the forum is down, I have a sinking feeling that it has met it's maker but am hoping that I am wrong. Thanks in advance for any input. Cheers

-

This is the latest on production by country. I don't imagine that all of it has been accounted for in some of the countries listed https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/top-gold-producing-countries/

-

I found this very interesting…. IDK, maybe it’s just me but I wouldn’t be walking around NYC w all the au unless I had a armed guard next to me. Aaron

-

NOW is the time to invest in Gold and Silver mining stocks ( also physical gold and silver) if you can afford it! I have subscribed to various stock analysts news letters over the last 18 years, and have found that Michael Oliver 's Newsletter is the most accurate I have come across so far. He is saying NOW is the time! His technical analysis and momentum indicators are giving the green lites. He feels gold will be at $1360 by the end of January. He also says 2019 will be an excellent year for the metals, and to expect some fast upward moves in price. A lot of the stocks are still near their price lows for the year. You want to buy low and sell high. With the gold and silver markets very small in size , when the big money starts to pour in, we will see explosive upwards moves in the prices. When gold hit close to $2000 an oz about 10 years ago, a lot of mining shares were 4x higher in price than they are today. I came across Mike Oliver 's commentary at King World News . com He currently has 2 podcasts there you can listen to, to get it straight from the horses mouth! Don't depend on a redneck ( me) for your investing advice. LOL. I wish you all the best in 2019! Detecting and investing.

-

As per the recent press released by Anaconda Mining ,They are glad to announced that they sold 3,491 ounces of gold in Q1 2022 (three months ended March 31, 2022) They also update about the water managements issue which have fixed for the mining procedure at the Argyl open pit mine . All dollar amounts are in Canadian Dollars. The Company expects to file its first quarter financial statements and management discussion and analysis by April 28, 2022 First Quarter 2022 Highlights Anaconda sold 3,491 ounces of gold in Q1 2022, generating metal revenue of $8.0 million at an average realized gold price1 of $2,296 (US$1,813) per ounce sold. Point Rousse produced 2,813 ounces of gold in Q1 2022, an 11% increase compared to Q1 2021, however lower than planned due to operational challenges in the Argyle Pit which required mill throughput to be maintained with low-grade Pine Cove stockpiles. Mine operations moved 68,877 tonnes of ore during the first quarter from Argyle, an increase over the previous year but behind plan for 2022, as water management issues impacted the mine's ability to drill and blast in March. The Pine Cove Mill processed 104,495 tonnes during Q1 2022, of which 28,301 tonnes were from low-grade Pine Cove stockpiles. The mill achieved a strong average recovery rate of 86.1% despite the lower-grade profile of mill throughput. For Stog'er Tight, the Company is finalizing internal pit designs in anticipation of a potential development scenario; the Company has now received tree cutting and Crown Land permits and is in the process of finalizing the Mining Lease. Exploration drilling at Point Rousse identified two new mineralized systems within the Goldenville Trend, intersecting 2.09 g/t over 5.7 metres and 1.38 g/t over 5.7 metres (press release dated March 31, 2022). As of March 31, 2022, the Company had a cash balance of $3.6 million and an undrawn revolving credit facility of $3.0 million. Preliminary working capital deficit1 at the end of the quarter was $6.5 million, which includes $3.2 million in deferred revenue associated with a gold prepayment facility which will be delivered into over the next six months. The deficit also reflects the short-term impact of the cessation of mining due to the water management issue. ABOUT ANACONDA: Anaconda Mining is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the top-tier Canadian mining jurisdictions of Newfoundland and Nova Scotia

-

According to ICMJ, gold has just broke the 2K threshold, $2057. I'm sure it will be up and down for a while.

-

What brand of detector would you need to find this? (If it was buried.) https://survivalupdate.com/a-12-million-dollar-solid-gold-cube-appears-in-central-park/

-

Is that a legit story and if so, did anyone figure out where the finds ware coming from? https://nypost.com/2020/12/12/mysterious-gold-jewelry-washes-up-on-venezuelan-beach/

-

And ... Why does it not corrode easily? It is all explained by Einstein's Theory Of Relativity. https://www.livescience.com/58245-theory-of-relativity-in-real-life.html Most metals are shiny because the electrons in the atoms jump from different energy levels, or "orbitals." Some photons that hit the metal get absorbed and re-emitted, though at a longer wavelength. Most visible light, though, just gets reflected. Gold is a heavy atom, so the inner electrons are moving fast enough that the relativistic mass increase is significant, as well as the length contraction. As a result, the electrons are spinning around the nucleus in shorter paths, with more momentum. Electrons in the inner orbitals carry energy that is closer to the energy of outer electrons, and the wavelengths that get absorbed and reflected are longer. [Sinister Sparkle Gallery: 13 Mysterious & Cursed Gemstones] Longer wavelengths of light mean that some of the visible light that would usually just be reflected gets absorbed, and that light is in the blue end of the spectrum. White light is a mix of all the colors of the rainbow, but in gold's case, when light gets absorbed and re-emitted the wavelengths are usually longer. That means the mix of light waves we see tends to have less blue and violet in it. This makes gold appear yellowish in color since yellow, orange and red light is a longer wavelength than blue. Gold doesn't corrode easily The relativistic effect on gold's electrons is also one reason that the metal doesn't corrode or react with anything else easily. Gold has only one electron in its outer shell, but it still is not as reactive as calcium or lithium. Instead, the electrons in gold, being "heavier" than they should be, are all held closer to the atomic nucleus. This means that the outermost electron isn't likely to be in a place where it can react with anything at all — it's just as likely to be among its fellow electrons that are close to the nucleus.

-

Is this a look into the future for more countries. ....Gold is money....

-

https://www.livescience.com/srivijaya-island-of-gold-discovered?utm_source=notification

-

I'm having a discussion with an engineer friend about gold. I am of the contention that there has been much more gold mined and found than what is reported. Well ... what is my starting report? Let's go with this one as I don't really know how to prove or disprove my assumption. I don't want this to be 'consensus science' which is in vogue right now but I guess without true gold facts there has to be a certain amount of belief in known gold produced each year and reserves in conjunction with industrial and aesthetic uses over all time on earth. I don't really care about how much is left or not mined or in reserves. I found this statement when I did a Google search: Between all of the gold sources in the world, current estimates suggest that roughly 2,500 to 3,000 tons of new gold is mined each year. At present, experts believe that the total amount of above ground gold in the world stands at just over 190,000 tons. The source of this statement is Provident Metals. Is this over or under? If this topic has been done please point me to the thread and we can delete this one.