Lynk

Full Member-

Posts

71 -

Joined

-

Last visited

Content Type

Forums

Detector Prospector Home

Detector Database

Downloads

Everything posted by Lynk

-

Thank you. The coil does look very nice. I am looking forward to your thoughts on it.

-

Congrats! Where did you order it from?

-

The stock traded up 18% on the release with the communications segment beating guidance. Interesting to all of us is that the Minelab segment's revenue missed at $74mm. Guidance was $75-80mm. Codan maintained its Minelab margin guidance, so pricing was stable. It just sold fewer units. Always hard to say what caused the miss, but competition has obviously heated up and production seemed delayed. The management call is February 16th. Analysts generally ask about product releases on that call. ASX RELEASE 24 January 2023 Trading Update Codan Limited (ASX:CDA) (Codan) is pleased to provide the market with a trading update for the half year ended 31 December 2022 (H1 FY23). At the AGM in October 2022, the Codan Board expected that revenue for H1 FY23 would be in the range of $198 million to $215 million and this would generate a net profit after tax between $25 million and $30 million. The unaudited revenue achieved in H1 FY23 was $212 million and the net profit after tax may now approach $31 million. Highlights: • Minelab unaudited revenue was slightly below the guided range at $74 million, however the business is still expected to deliver a segment profit margin of 30%, in line with guidance. • Communications unaudited revenue was $137 million, slightly exceeding expectations and the segment profit margin will improve to 25%. • Communications orderbook as of December 2022 has increased 16% from 30 June 2022 to $173 million.

-

GPX 6000 Speaker Audio Feedback Fix - My Experience

Lynk replied to Dutchman4's topic in Minelab Metal Detectors

My machine is currently being shipped back to me, but I am happy with the ease of this process. I was notified they received it on Jan 19 at 10:52am and was then notified on Jan 20 at 8:46am it was fixed and shipped. So fixed and shipped in less than 24 hours. The perfect scenario is this issue didn't exist in the first place, but I am glad they are fixing it and in what seems like a fast manor. As has been said, it seems like a good idea for performance and resale value to have this fix performed while there is warranty remaining. -

Thank you. Always appreciate your color. Manticore's vs 900's capabilities for nugget hunting will be my deciding factor, so even experience with the 11" coil is helpful. The sensitivity of the 800, even with the 11", converted me from some gold specific machines.

-

Gold Monster Vs 24K Vs Gold Bug 2 Or...........

Lynk replied to Steve Herschbach's topic in Detector Prospector Forum

Is there really a reason for a gold specific VLF anymore? I purchased the Equinox 800 from Gerry after he made a very excellent post right before the price increase pitching it as an incredibly capable gold machine. He was 100% right. I have had, and sold, the GB2, Whites GMT, and the Gold Monster. I still have a 24K, but my next VLF purchase will be the 900 or the Manticore, pending reviews. I am sure I am missing many obvious reasons for a pure gold machine, but it seems like today's technology (hardware and software) negate most of them. -

One comment that stood out in the video was there is improved discrimination depth. They said targets will hold their IDs deeper than before.

-

From an end user standpoint it's wonderful. Choices (options) are valuable and we are also long the option the 900 performs nearly as well as the Manticore, but for less money. As a business, that's another question and since I am more vested in buying metal detects than Codan equity I'm not too worried about that.

-

I was trying to reply to Simon's post, but definitely have not mastered that. Apologies.

-

Yep, that + is a selling point, they want to reserve that for the higher priced Manticore. It's also the one with Target trace which is a big advantage of the + Maybe the "+" also refers to the additional power to the coil.

-

I haven't paid attention to what time zones the company has focused live events on in the past, but that's a great observation about connecting the best time to the end market if they have historically varied.

-

Funny, checked after your post and the local times for the announcement are on Minelab's FB page. 330 PM Chicago Dec 1 / 800 PM Dec 2 Adelaide

-

Sorry to repost, but something is coming in FY23: https://codan.com.au/investor-centre/presentations/ It's the August 24th transcript - Sure. And the new gold detector releases that you've spoken that might be in the pipeline, are they still an FY23 event? Or, are they pushed out to later years now? The second-half of 2023. Second-half of '23. So, around that February period. I think it's a bit later than that. Yeah. Yeah.

-

Management had commented Minelab does plan to release a new gold detector in the second half of its fiscal year. It would also be smart of them to announce it now to try to distract attention from the Axiom. While I don't know a new Monster does much distracting, doesn't it seem a likely candidate given its age? Even though I am not likely a first adopter this stuff is fun to follow, speculate on, and certainly excites the forum.

-

In the last earnings call Codan held on August 22, management said they have a new gold detector(s) release planned for the second half of 2023. A Monster (or SDC type) replacement makes sense and the timing of this deal isn't out of line with the commentary. Analyst - "And the new gold detector releases that you've sort of spoken that might be in the pipeline, are they still in FY'23 event? Or are they pushed to later years now?" CFO - "Second half of 2023." Analyst - "Second half of '23, so around that sort of February period?" CFO - " I think it's later than that. We've not really factored them into our comments, Jason, because they look more back end of the financial year. So..." Whatever the case is, all we really know for sure is there is a great deal on the table for someone looking for this combo now.

-

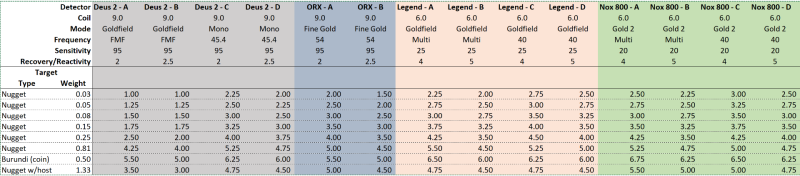

Thank you. I think I've inserted it. It doesn't look like I can attached an Excel file, but zip folders are OK. The Excel file is in the zip folder. I hope this helps (and works). Metal Detector Comparison 2022.10.24.zip

- 28 replies

-

- minelab equinox

- xp deus 2

-

(and 1 more)

Tagged with:

-

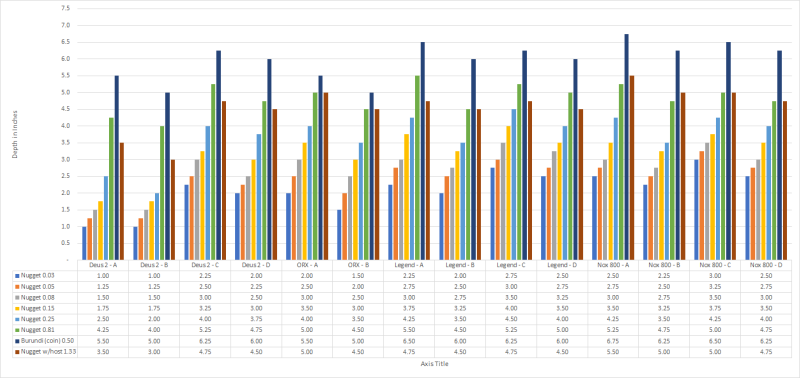

Jeff - Thank you for all this work and sharing your results. Also, I hope you heal fast and are back in the field as soon as possible. GotAU - Great idea. I had a minute, so I took a crack at it. It would be great to see what your students produce, too. If there are any errors here let me know and I will fix them.

- 28 replies

-

- minelab equinox

- xp deus 2

-

(and 1 more)

Tagged with:

-

Gold Price Expected To Rise Significantly Soon

Lynk replied to Aureous's topic in Detector Prospector Forum

jasong brings up a good point that asset prices are not absolute, but relative to other assets. When we quote the price of gold, it's usually in USD. That said, what's the price of USD? The US Federal Reserve has been the most aggressive in raising rates, which is attracting capital looking for yield, and as Phrunt points out, safety. Gold in Yen is up over 20% in the last year, but the Japanese central bank is bent on keeping rates at zero. So much so that it recently stepped in to prop up the Yen for the first time since the late 90's. Ultimately, I cognitively separate the riddle of the gold markets and riddle of putting gold under the coil or in the box. It's a certainty I will still be avidly reading this forum and on the hunt if gold trades back to a sub $300 range. (In USD to be clear!) -

Gold Price Expected To Rise Significantly Soon

Lynk replied to Aureous's topic in Detector Prospector Forum

There are two more Fed meetings this year - 11/2 and 12/14. The market currently prices in a 93% chance of another 75bp (basis points or 3/4 of a full percentage point) in November and a 96% chance of 50bp in December. Hikes are priced in through the May meeting, although to a much lesser degree. Starting in June the markets see a higher probability of rates being cut. It's important to note these are just expectations and they adjust with every significant economic update. All else being equal, rates moving into real (government rates less inflation) territory make it hard for the price of gold to move higher. -

Gold Price Expected To Rise Significantly Soon

Lynk replied to Aureous's topic in Detector Prospector Forum

The price of gold is driven by a number of different factors starting with basic supply and demand. Those drivers are more than just production and non-investment consumption, though. Price drivers get more complicated from an investor's perspective as gold is generally priced in US dollars and will move depending on what the dollar is doing relative to other currencies. Price is further complicated by the fact the dollar and gold move relative to real interest rates (think a treasury yield minus inflation). If real rates move up or are at least expected to relative to other currencies than investors will push up the dollar. A higher dollar would generally be a negative factor for the price of gold. Also, if investors can earn a positive real yield than gold is less attractive as it doesn't pay anything. If real yields are negative, than than gold is more attractive as the dollar is likely losing buying power. On Russia, the gold it produces and wants to sell will likely leak into the market. Both India and China have been buying Russian crude.